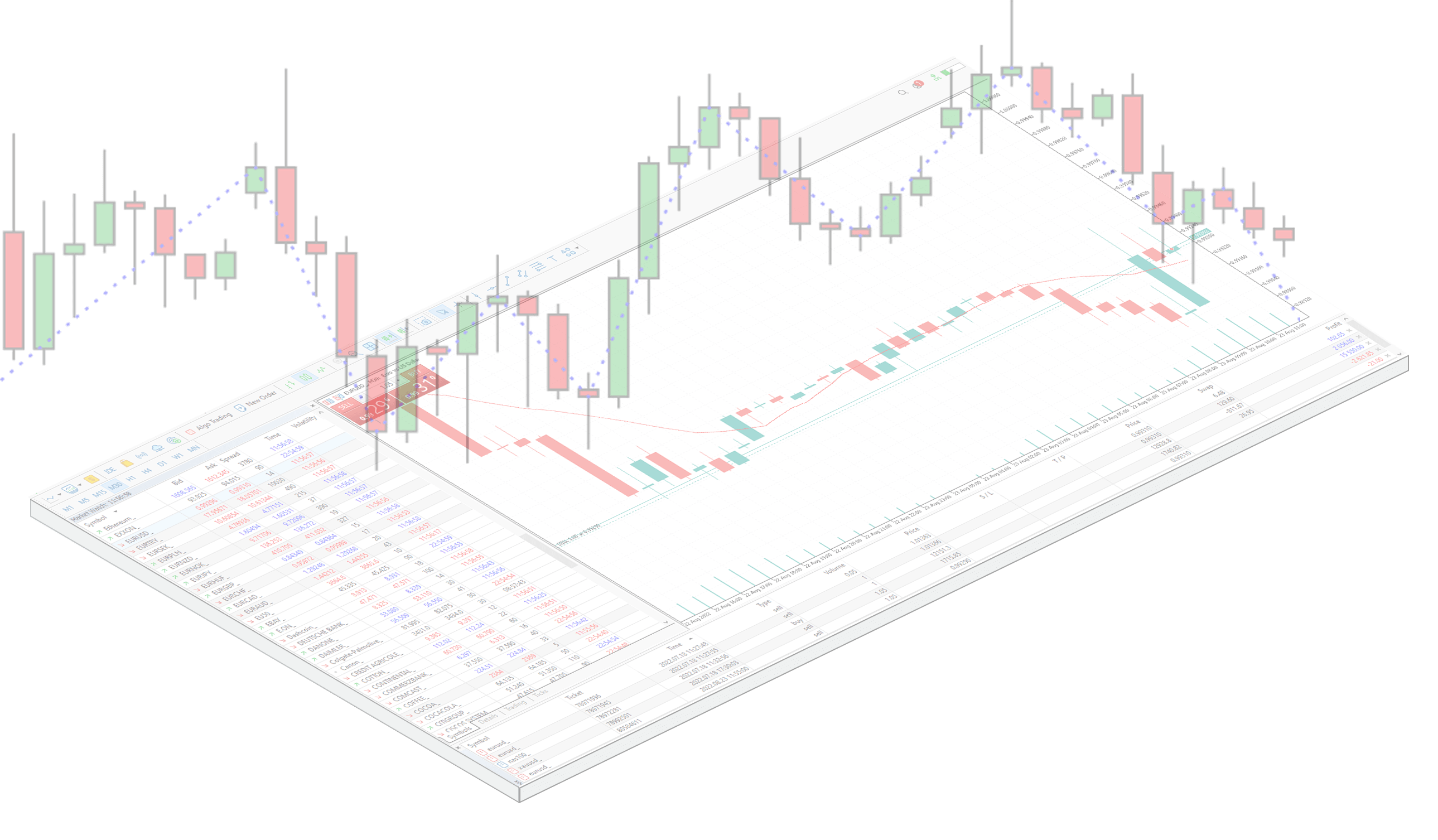

Forex

Trade forex direct on interbank pricing via our low-latency networks.

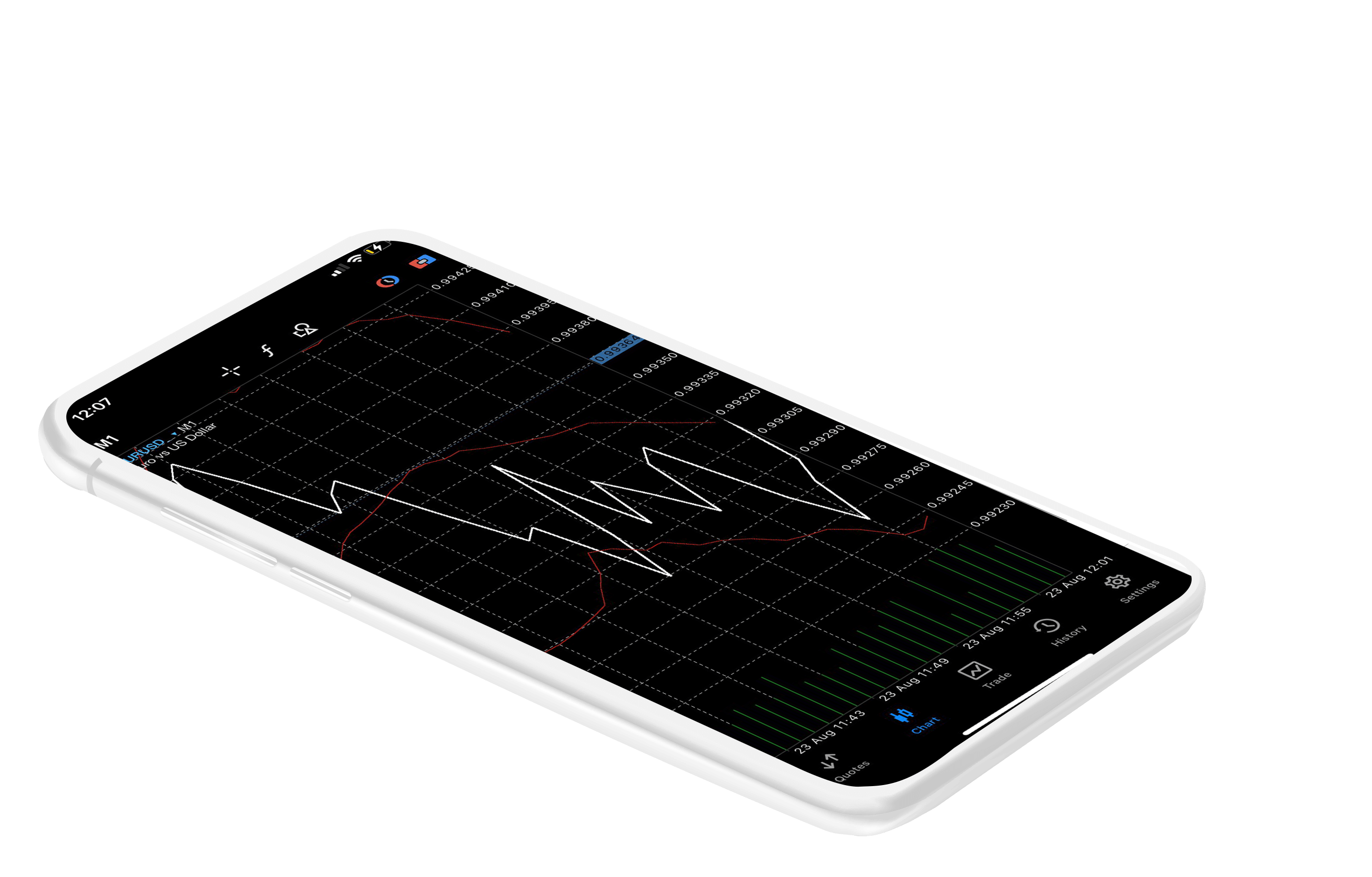

Trade Forex and other markets 24 hours a day

The markets do not sleep - Never miss an opportunity and trade around the clock Monday to Friday

No restriction on forex trading

No restriction on trading styles with optimized liquidity for algo trading, robots and expert advisors

Positive order execution

STP order execution direct to multiple liquidity providers with no dealing desk intervention

1:500 Leverage

Trade with up to 1:500 leverage

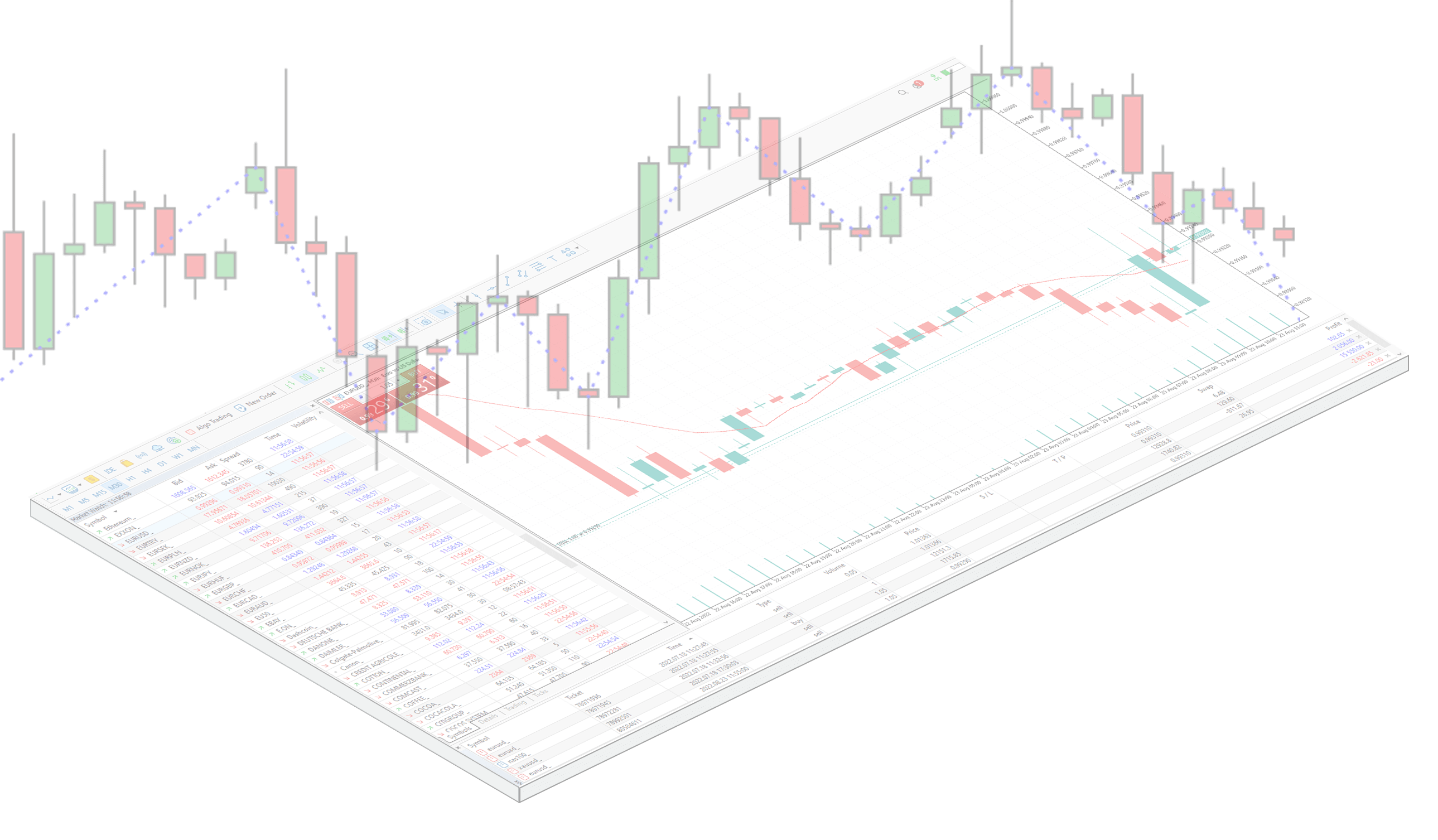

What is Forex Trading?

Forex trading is the buying or selling (also known as going long or short) of a currency pair, with the aim to profit on future price direction.

For example, if a trader expects the euro to rise in value relative to the US dollar, they would place a buy trade on EUR/USD thus buying euros and simultaneously selling US dollars.

In contrast, if the euro were to subsequently fall against the US dollar, and the trader had a buy order in place, the trader could close the trade but it would result in a loss.

Start Trading

Why Trade Forex with Invest M?

Secure and Safe

Creating a safe and secure trading environment for our clients

Tier-1 Banks

Connectivity to executing venues with pricing from tier-1 banks, non-bank and high-frequency liquidity to form a deep liquidity web

Advanced Technology

Our forex trading servers are located in the London Equinox LD4 data centre, cross connected and co-located to multiple tier-1 institutional liquidity providers

Pure Agency Broker Model

No conflict of interest with our clients

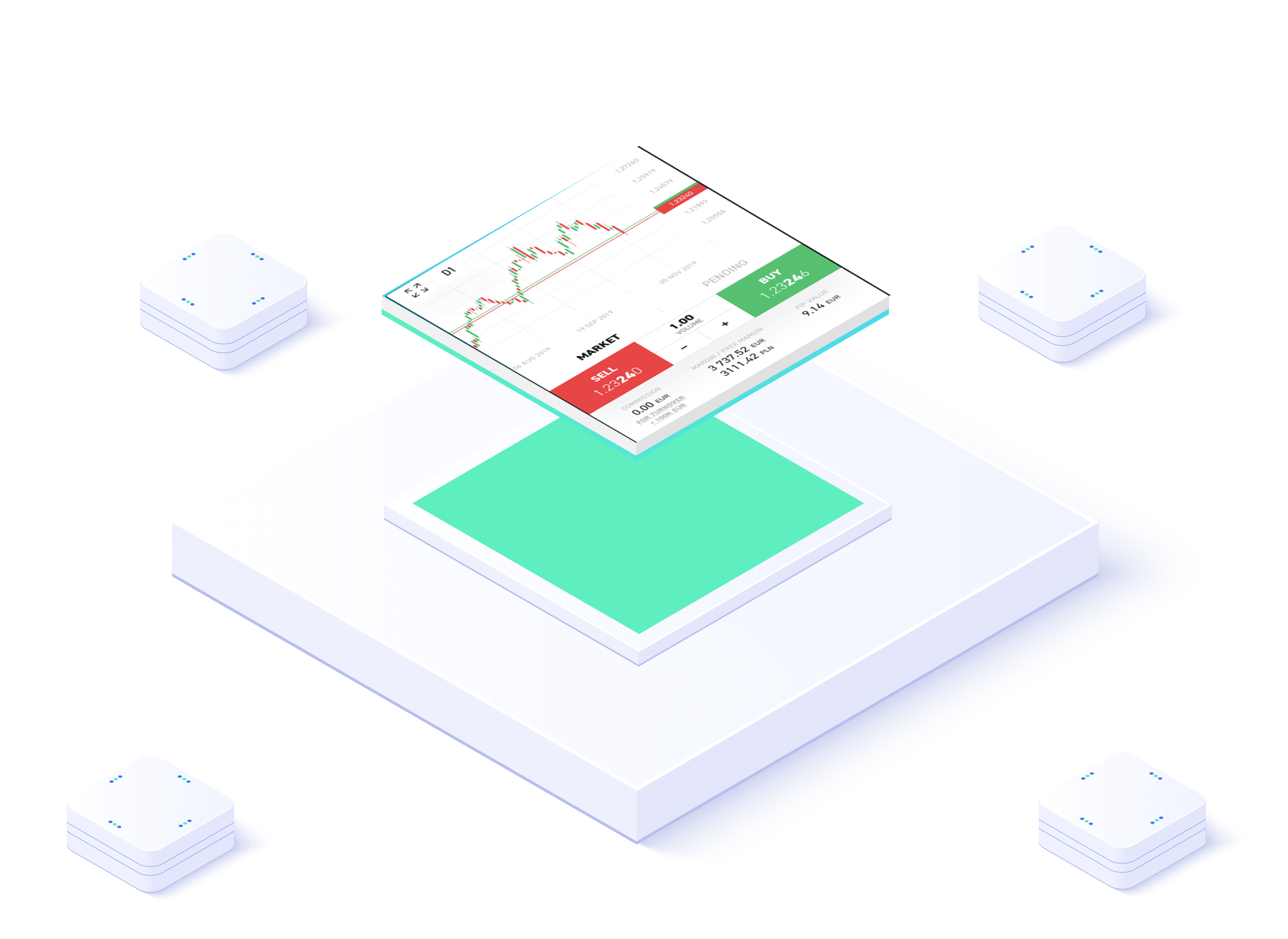

Forex Trading Example

Buy EURUSD

Indices

Trade indices, just as you would trade forex, direct on interbank pricing via our low-latency networks

Trade Forex and other markets 24 hours a day

The markets do not sleep - Never miss an opportunity and trade around the clock Monday to Friday

No restriction on forex trading

No restriction on trading styles with optimized liquidity for algo trading, robots and expert advisors

Positive order execution

STP order execution direct to multiple liquidity providers with no dealing desk intervention

1:500 Leverage

Trade with up to 1:20 leverage

What is Indices Trading?

Indices trading is the buying or selling (also known as going long or short) of a CFD based on a Financial Index (a basket of exchange listed instruments), with the aim to profit on future price direction.

For example, if a trader expects the Dow Jones 30 to rise in value, they would place a buy trade on US30.

Were US30 to subsequently rise, and the trader had a buy order in place, the trader could close the trade resulting in a profit.

In contrast, if US30 were to rise and the trader had a sell order in place, the trader could close the trade but it would result in a loss.

Start Trading

Indices Trading Example

Buy US30 (Dow Jones 30)

Commodities

Trade energy, metals and soft commodities, direct on interbank pricing via our low latency networks.

Trade Forex and other markets 24 hours a day

The markets do not sleep - Never miss an opportunity and trade around the clock Monday to Friday

No restriction on forex trading

No restriction on trading styles with optimized liquidity for algo trading, robots and expert advisors

Positive order execution

STP order execution direct to multiple liquidity providers with no dealing desk intervention

1:500 Leverage

Trade with up to 1:500 leverage

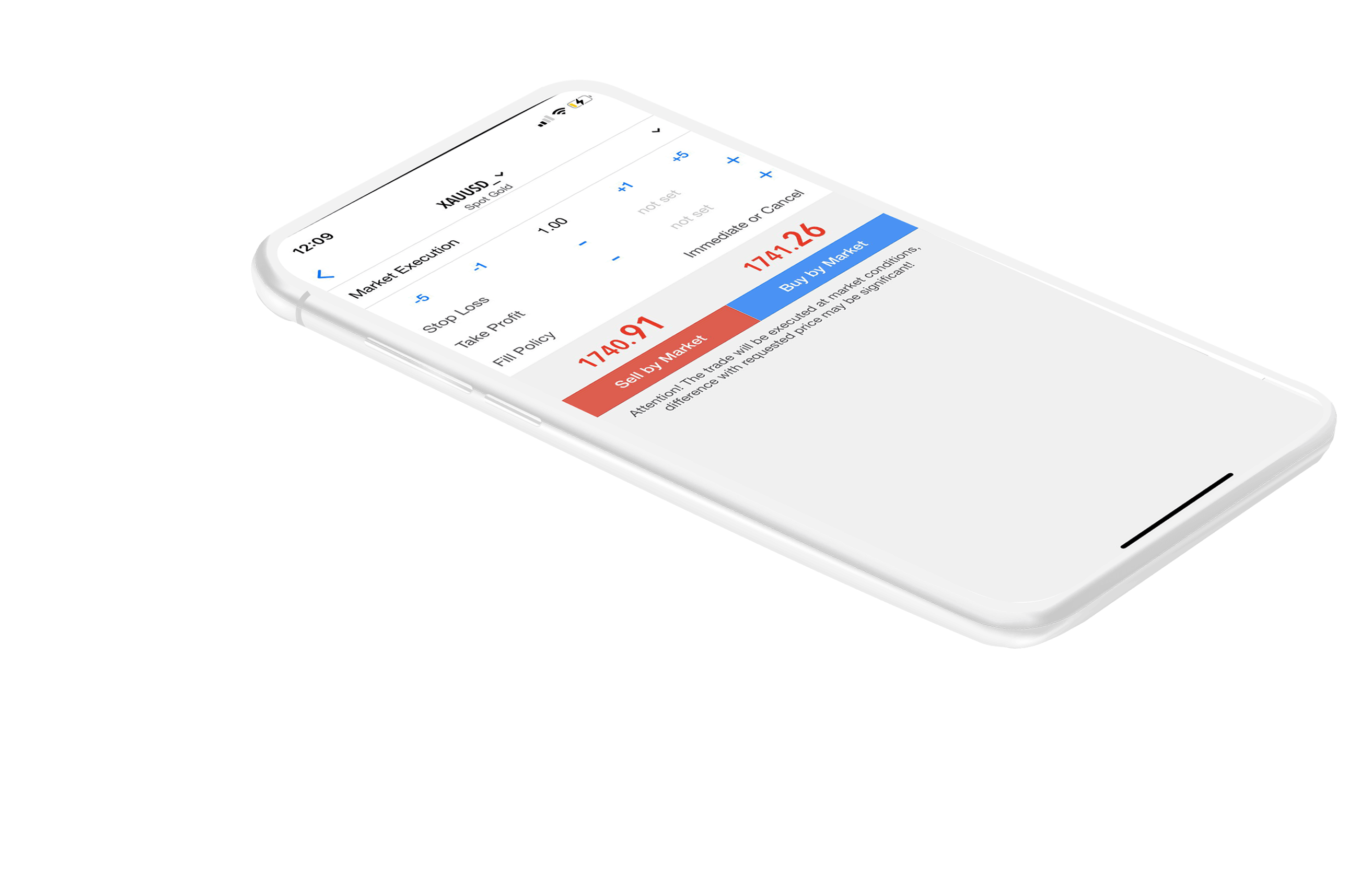

What is Commodities Trading?

Precious metals trading is the buying or selling (also known as going long or short) either Gold or Silver versus its value in US dollars, with the aim to profit from future price fluctuations.

Energy trading is the buying or selling (also known as going long or short) either Brent Crude or WTI Crude, with the aim to profit on future price direction.

For example, if a trader expects Brent Crude or Gold to rise in value, they would place a buy trade on UK OIL or XAUUSD.

In contrast, if UK OIL or Gold were to fall and the trader had a buy order in place, the trader could close the trade but it would result in a loss.

Start Trading